January is a reset month for the markets, but it is rarely a quiet one. Liquidity conditions are still normalizing after the year-end period, and early price moves can be sharp as institutions reposition for the new year. This often leads to exaggerated reactions, false breakouts, or strong directional moves that test trader discipline early.

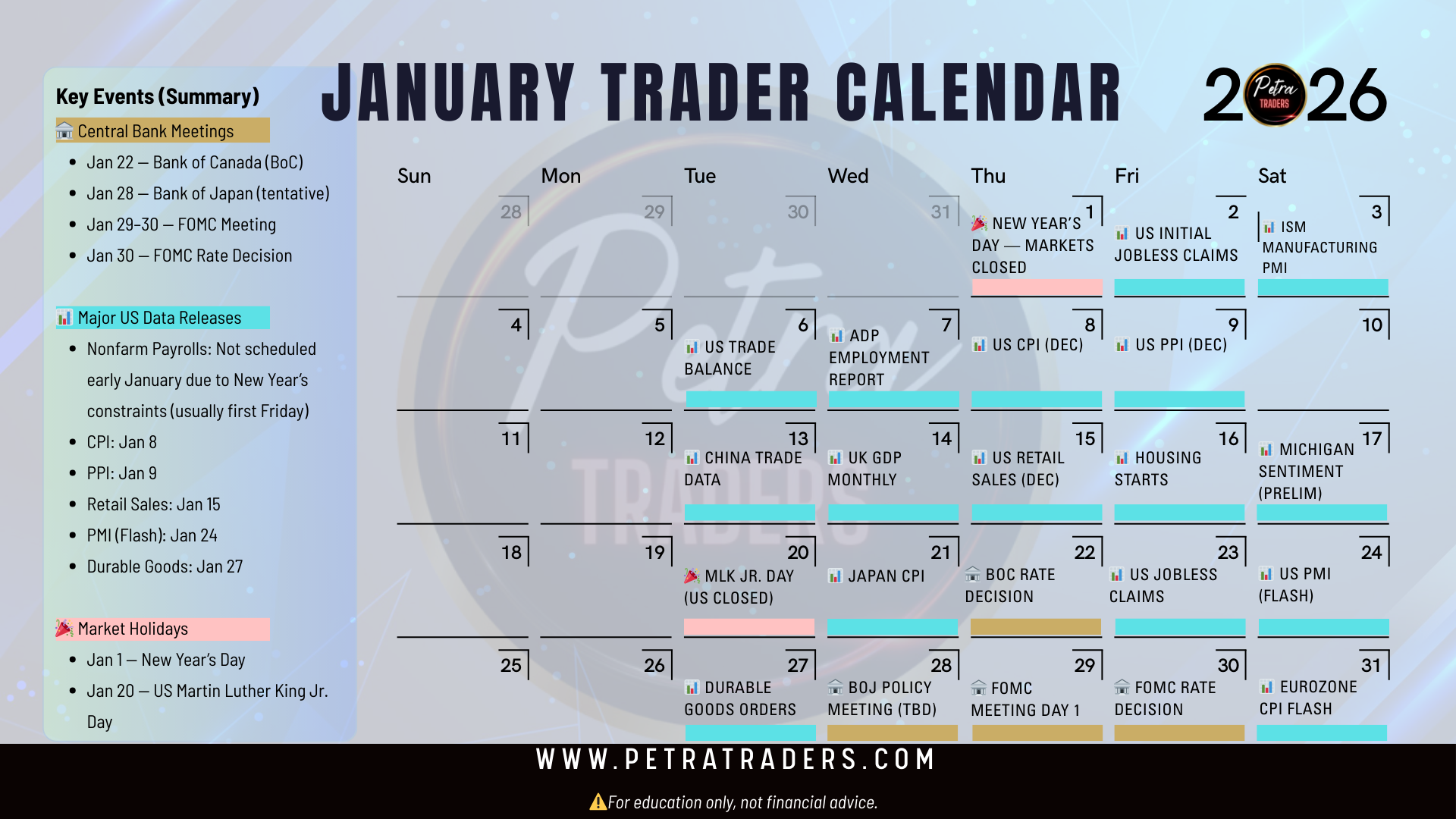

One of the biggest areas to watch is central bank communication. With key meetings and policy signals appearing later in the month, traders should pay close attention to interest rate expectations rather than just the decisions themselves. Forward guidance, tone, and inflation outlooks can move currencies, gold, and indices even before official rate changes occur.

Inflation and employment data are also critical in January. CPI, PPI, and labor-related reports tend to shape market narratives quickly, especially after the holiday lull. These releases can trigger sudden volatility, widen spreads, and invalidate technical setups if traders are unprepared. Timing and risk management matter more than prediction.

Another often-overlooked factor is market psychology. January can bring optimism, overconfidence, or aggressive positioning as traders chase a “strong start” to the year. This is where mistakes happen. Not every move needs to be traded, and sitting out during high-risk periods is sometimes the most professional decision.

At PetraTraders, we encourage traders to treat January as a month of awareness and structure. Focus on preparation, respect high-impact events, and trade selectively. A disciplined start to the year builds habits that matter far more than any single trade.

Happy New Year!

📊 Stay Updated with Petra Traders

Visit www.petratraders.com

⚠️For education only. Not financial advice.

#PetraTraders #TraderCalendar #JanuaryMarketOutlook #ForexEducation #GoldMarket #CentralBankWatch #EconomicData #MarketVolatility #TradingDiscipline #TradePreparation