Traders Prepare for Potential Volatility in the Forex Market

The upcoming U.S. economic calendar is loaded with high-impact releases that could significantly influence forex price movements — especially for USD-related pairs such as EUR/USD, GBP/USD, XAU/USD, and USD/JPY.

These reports will provide fresh insight into the strength of the U.S. economy, inflation pressures, and the likelihood of the Federal Reserve maintaining its higher-for-longer interest rate stance.

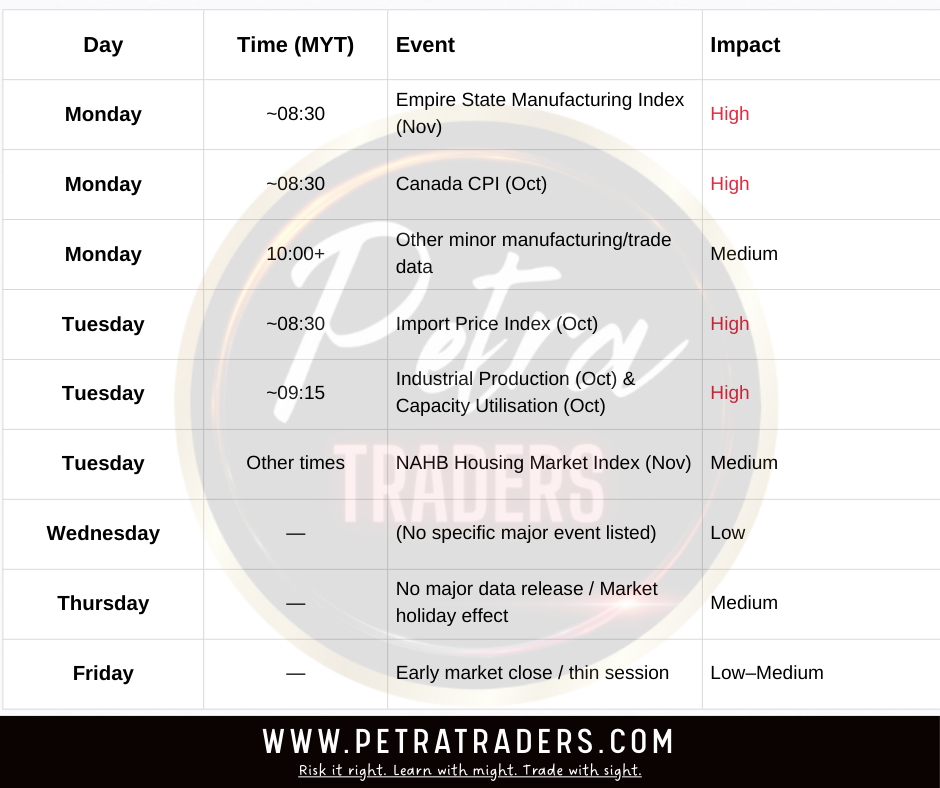

📅 Key Data to Watch

- Non-Farm Payrolls (NFP)

- Measures the change in the number of employed people during the previous month, excluding the farming industry.

- Why it matters: A stronger-than-expected NFP reading usually strengthens the USD, as it supports the Fed’s case to keep interest rates elevated. Conversely, weak data may revive rate-cut expectations and weaken the USD.

- Expected impact: High volatility within the first 15–30 minutes after release. Traders should expect rapid moves on XAU/USD, EUR/USD, and USD/JPY.

- Next NFP release: Fri 7 Nov 2025 • 20:30 MYT • USD pairs likely to react strongly

- ISM Manufacturing & Services PMI

- Gauges economic activity across major sectors.

- Why it matters: These numbers show whether the economy is expanding or contracting. Readings above 50 indicate growth, below 50 suggest slowdown.

- Expected impact: A strong PMI can boost USD demand; a weak print could trigger a risk-off move, favoring gold or JPY.

- Average Hourly Earnings

- Reflects wage inflation — a key component the Fed watches to gauge inflation persistence.

- Why it matters: Higher wages can keep inflation sticky, reducing the chance of near-term rate cuts.

- ADP Private Employment Report

- Often acts as a preview for NFP. While not always accurate, large deviations from forecast can move markets early.

📊 Market Implications

- A solid batch of data would likely reinforce USD strength, pressuring gold and major currency pairs like EUR/USD and GBP/USD.

- A weak showing could trigger a sharp pullback in the dollar, as traders would anticipate a more dovish tone from the Fed heading into December.

- Volatility spikes are common during these periods, and spreads may widen temporarily. Execution quality can vary sharply between brokers.

🧭 Petra Traders’ Professional Advice

- Risk Management: Reduce trade size or avoid opening new positions 30 minutes before the data release.

- Plan Entries: Wait for the post-news candle confirmation before taking trades; avoid reacting emotionally to the initial spike.

- Key Pairs to Watch:

- EUR/USD → Possible 1.1400–1.1500 support range reaction

- XAU/USD (Gold) → Watch 2670–2700 zone if USD strengthens

- USD/JPY → Strong USD could retest 157.50 region

✅ Summary

This week’s U.S. data releases will likely set the tone for short-term market direction and investor sentiment heading into mid-November. Traders should stay alert, follow verified economic calendars, and adapt quickly to volatility spike

⚠️ Disclaimer

Trade at your own risk. Not financial advice.

#PetraTraders #NFP #GoldNews #FundamentalAnalysis #ForexMalaysia #TraderCommunity