How it started, what it means for the economy, and what traders should know

🏛️ What is a Government Shutdown?

🏛️ What is a Government Shutdown?

A government shutdown occurs when the U.S. Congress fails to approve funding bills or a temporary budget to keep government agencies operating. Without funding, many federal departments partially or fully suspend their activities — leaving hundreds of thousands of employees furloughed (unpaid leave) and essential staff working without pay.

In this case, the 2025 shutdown began on 1 October 2025 after Congress could not agree on a new budget due to political deadlock over spending priorities.

⏱️ The Longest Shutdown in U.S. History

As of 5 November 2025, the government shutdown has reached 36 days, officially making it the longest in American history — surpassing the 35-day shutdown that occurred between December 2018 and January 2019.

This record-setting event has caused widespread disruptions across the U.S. economy and government operations.

📉 Economic Effects and Financial Impact

📉 Economic Effects and Financial Impact

1. Reduced Consumer Spending

Hundreds of thousands of federal workers have missed multiple paychecks, leading to decreased consumer spending and slower retail sales — directly weakening domestic demand.

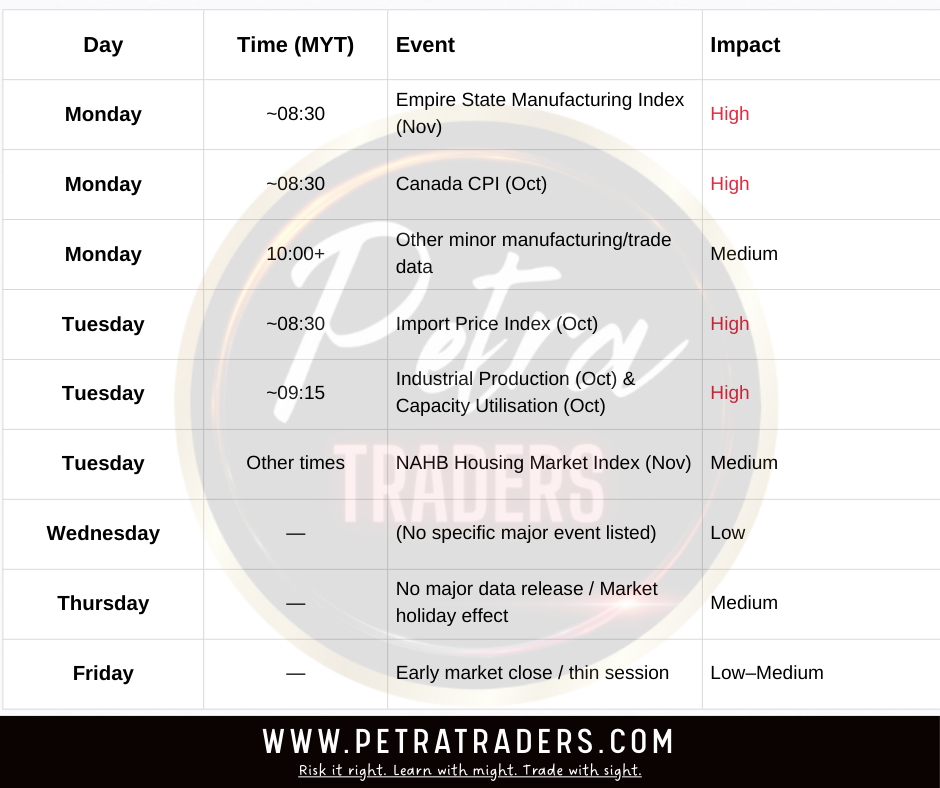

2. Delayed Economic Data

Key agencies such as the Bureau of Labor Statistics (BLS) and Bureau of Economic Analysis (BEA) have paused their data releases, causing an economic data blackout. Traders, investors, and analysts now lack timely updates on inflation, jobs, and GDP growth — increasing uncertainty in financial markets.

3. Air Travel and Infrastructure Impact

The Federal Aviation Administration (FAA) announced a 10% reduction in flights due to staff shortages. This disrupts travel, tourism, and cargo logistics — key contributors to U.S. GDP growth.

4. Estimated Cost

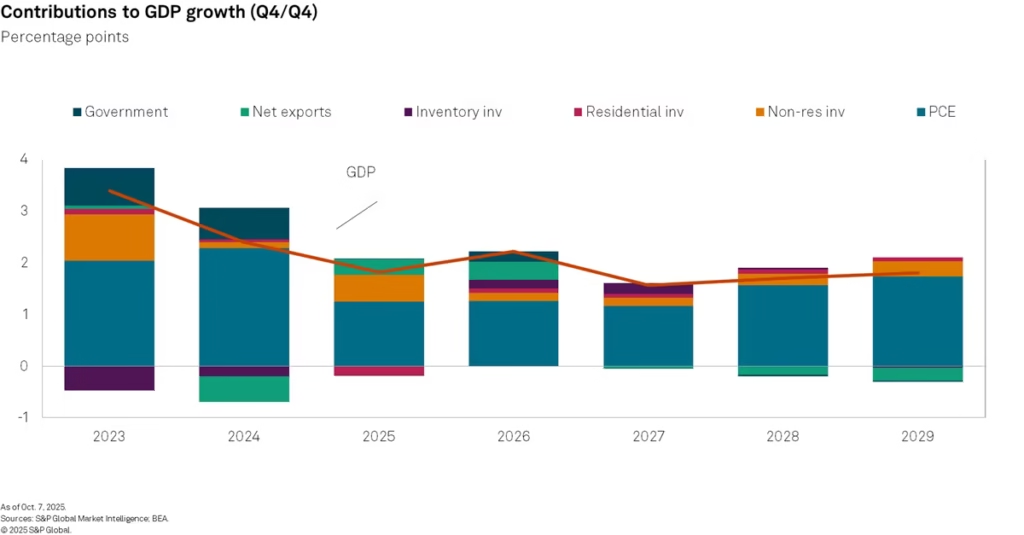

Analysts estimate the ongoing shutdown is costing the U.S. economy around $15 billion per week, potentially cutting up to 2% off GDP growth for Q4 2025 if it continues.

(Source: Bloomberg, Reuters)

5. Global Ripple Effect

International trade has been affected — for instance, U.S. agricultural officials missed a major trade expo in China, weakening export prospects. This uncertainty also impacts global investors, commodity prices, and emerging-market currencies.

💱 Impact on the Forex Market

-

The U.S. Dollar (USD) has remained relatively strong as investors treat it as a safe haven amid global uncertainty.

-

However, prolonged economic weakness or a political impasse could reduce confidence in U.S. fiscal stability, potentially weakening the dollar in the medium term.

-

Gold (XAU/USD) and JPY (Japanese Yen) may attract more buying as traders seek safety from volatility.

-

USD pairs like EUR/USD, GBP/USD, and USD/JPY are expected to experience higher-than-usual swings until government operations resume.

⚠️ Petra Traders Analysis

For traders in the Petra Traders community:

-

Expect higher volatility and unpredictable movement across major USD pairs.

-

Manage risk carefully — avoid over leveraging or trading during sudden news releases.

-

Until the shutdown ends, economic data releases may be inconsistent, leading to false breakouts or delayed reactions in the market.

🧭 Key Takeaway

The 2025 U.S. Government Shutdown is not just a political standoff — it’s a reminder that economic stability depends on governance.

This historic 36-day closure has already disrupted data flow, spending, and confidence.

For traders, it represents both a risk and an opportunity — those who stay disciplined, follow market structure, and manage positions wisely will emerge stronger.

⚠️ Disclaimer

Trade at your own risk. Not financial advice.

📊 Stay Updated with Petra Traders

Visit www.petratraders.com

#PetraTraders #NFP #GoldNews #FundamentalAnalysis #ForexMalaysia #TraderCommunity