What is a Pip in Forex Trading?

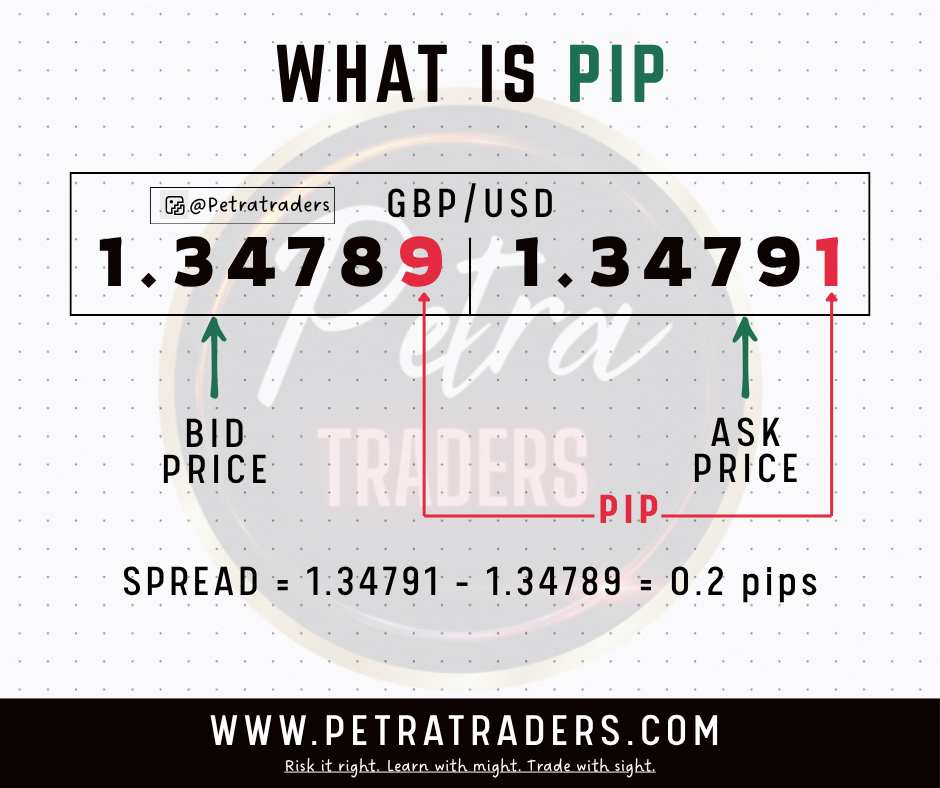

In forex trading, a pip stands for “percentage in point” or “price interest point.”

It represents the smallest standard unit of price movement in a currency pair.

🔹 1. Definition

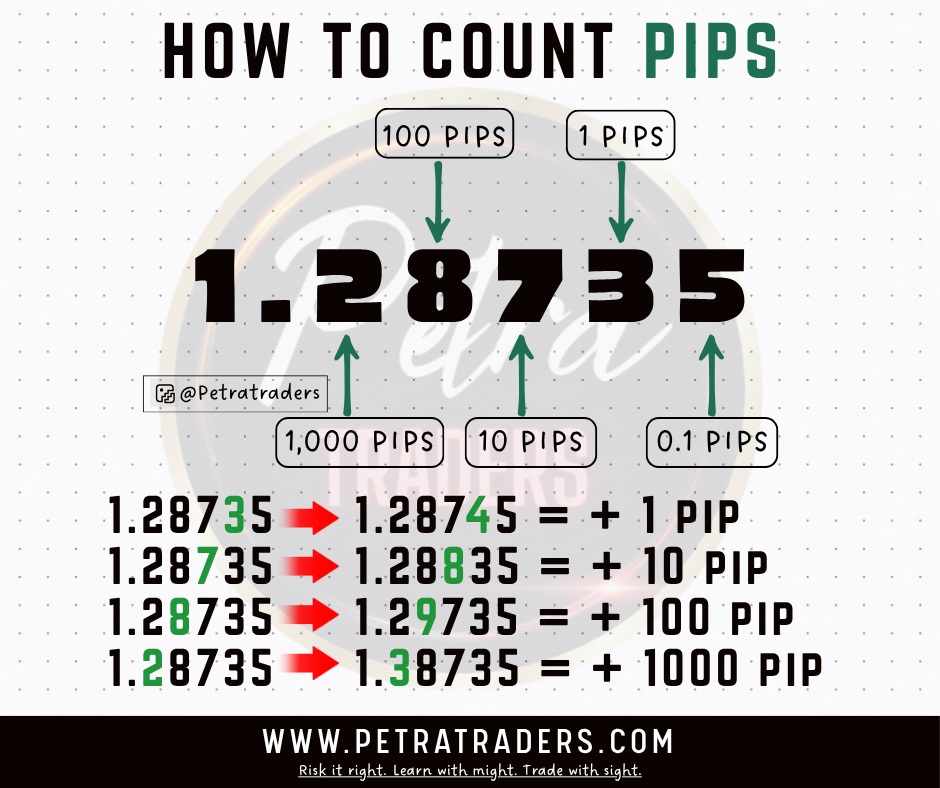

A pip shows how much a currency pair’s price has changed.

- For most currency pairs → 1 pip = 0.0001 (the 4th decimal place)

- For JPY pairs → 1 pip = 0.01 (the 2nd decimal place)

Examples:

- EUR/USD moves from 1050 → 1.1051 = 1 pip

- USD/JPY moves from 20 → 154.21 = 1 pip

💰 2. Pip Value

The monetary value of one pip depends on:

- The currency pair

- The trade size (lot size)

- The account currency

Approximate pip values:

| Lot Size | Units | Pip Value (USD pairs) |

| Standard Lot | 100,000 | $10 per pip |

| Mini Lot | 10,000 | $1 per pip |

| Micro Lot | 1,000 | $0.10 per pip |

Example:

If you buy EUR/USD at 1.1000 and close at 1.1050, you gain 50 pips.

⚙️ 3. Why Pips Matter

Pips are used to measure:

- ✅ Profit and loss

- 💵 Broker spread (transaction cost)

- 📈 Stop loss & take profit levels

They help traders quantify market movement and manage risk precisely.

📊 4. What Is a Pipette?

A pipette is 1/10 of a pip (0.00001) — used by some brokers for more precise quotes.

🧠 Summary

- 1 pip = the smallest price change in forex

- For most pairs: 0001 | For JPY pairs: 0.01

- Pip value depends on lot size and pair

- Understanding pips = better risk management & accuracy

#PetraTraders #ForexEducation #LearnForex #PipValue #ForexMalaysia #TraderCommunity