1. Yen under pressure & Japan’s alert

The Japanese yen plunged to a nine-month low at around ¥154.45 to the U.S. dollar, after the Bank of Japan (BOJ) maintained its ultra-loose policy. In response, Satsuki Katayama, Japan’s Finance Minister, issued a strong warning that the government is keeping a close watch on the currency market and is prepared to act if excessive, one-sided moves materialize. Reuters Implication for traders: Currency pairs involving the yen (like USD/JPY, JPY pairs) may see heightened volatility. Be mindful of potential sudden reversals or interventions.

2. Drop in India’s forex reserves

For the week ending 24 October 2025, India’s foreign exchange reserves fell by about US$6.9 billion, down to US$695.35 billion, according to the Reserve Bank of India. Reserves of both gold and foreign‐currency assets contributed to the decline. The Times of India Implication for traders: A shrinking reserve can suggest increased pressure on the currency or external vulnerabilities. For FX pairs like USD/INR or emerging‐market currencies, risk management is key.

3. Fed officials signal caution on cuts

Several officials from the Federal Reserve have publicly stated they do not support an imminent interest‐rate cut, citing unresolved inflation risks. This signals that the U.S. dollar may stay firm for longer than some market participants expect. Forex Factory Implication for traders: Dollar‐based currency pairs (EUR/USD, GBP/USD, and AUD/USD) may remain under pressure. Any expectation of a dollar decline should be backed by strong data or policy shift.

Summary & Trading Focus

- The USD remains in a position of relative strength given Fed hawkishness and safe-haven flows.

- The JPY is under notable pressure, with the possibility of policy or intervention headlines increasing risk.

- Emerging currencies (e.g., INR) may face external headwinds given reserve declines.

- Volatility may increase around central-bank communications and policy decisions.

Action Points for Petra Traders Community

- Review risk management on pairs involving JPY and USD — consider reducing size or widening stops.

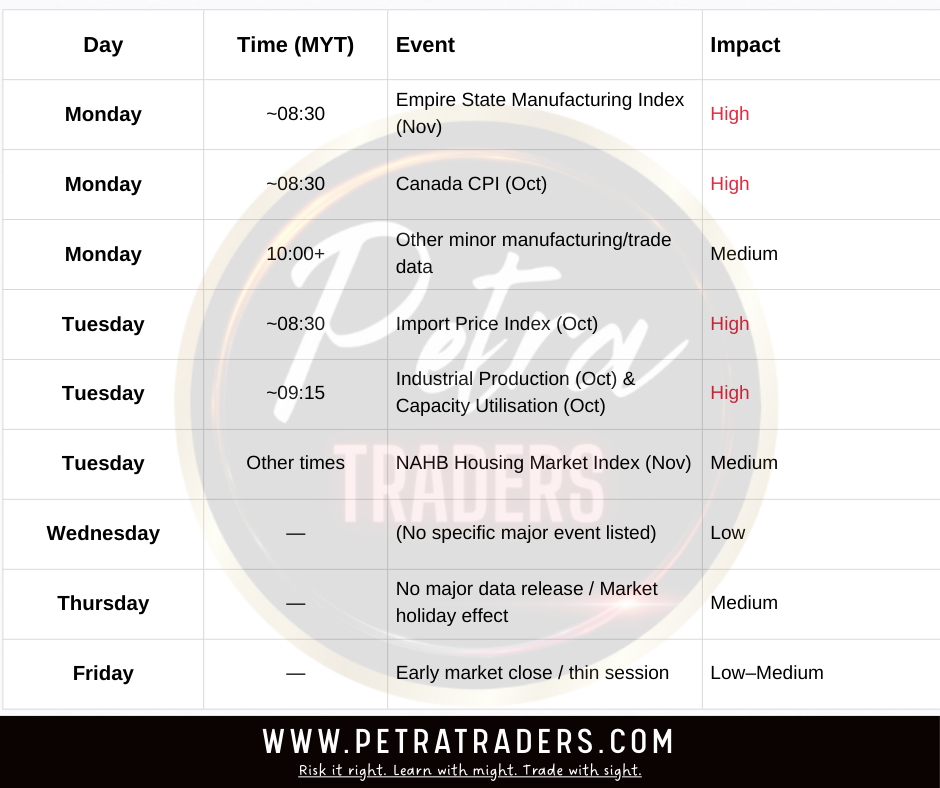

- Monitor economic data (inflation, trade, and reserves) for surprises — these may trigger sharper moves.

- Stay up to date with policy commentary from central banks — language matters and can move markets.

- Consider shorter timeframes or scalp strategies if volatility spikes around major news.