📈 Markets Brush Off Powell’s Warning as Global Central Banks Face Key Inflation Test

Despite Federal Reserve Chair Jerome Powell’s warning to stay cautious, traders are charging ahead. Markets are betting that rate cuts will come sooner than the Fed suggests — even as inflation proves sticky.

🔑 Key Points Traders Should Know

✅ Markets challenge the Fed

Investors are pricing in policy easing by mid-2026, ignoring Powell’s hawkish tone. Stocks and risk assets are climbing as confidence builds that inflation is under control.

✅ Global central banks in the same dilemma

The ECB, Bank of England, Bank of Japan, and RBA all face pressure to balance slowing growth with lingering inflation. Some may follow the Fed’s lead, but timing will differ.

✅ Inflation cooling — but not gone

Energy and housing costs remain the biggest obstacles. Core inflation is easing, yet still above targets.

✅ Bond yields stabilizing

US Treasury yields remain high but are leveling off, signaling that markets expect easier policy within months.

✅ Risk appetite returns

Investors are rotating back into risk assets:

- Global stocks gaining

- Gold consolidating near highs

- USD showing weakness

- Crypto markets attracting inflows

🧠 Why It Matters

This is a trader’s environment — volatility, optimism, and opportunity.

- Buy dips in strong trends.

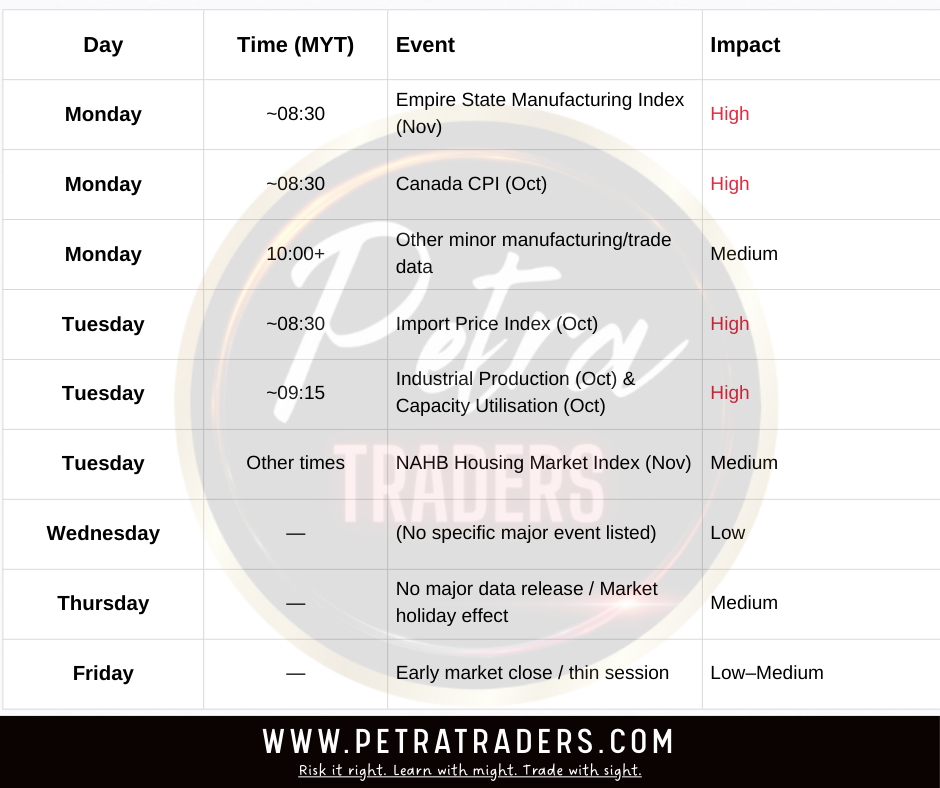

- Watch CPI data and central-bank speeches.

- Stay alert for sudden reversals if inflation spikes again.

🎯 Trading Takeaway

Markets may keep rising — but central-bank policy and inflation data remain the true drivers. Stay confident, but protect your capital.

⚠️ Disclaimer

Trade at your own risk. Not financial advice.